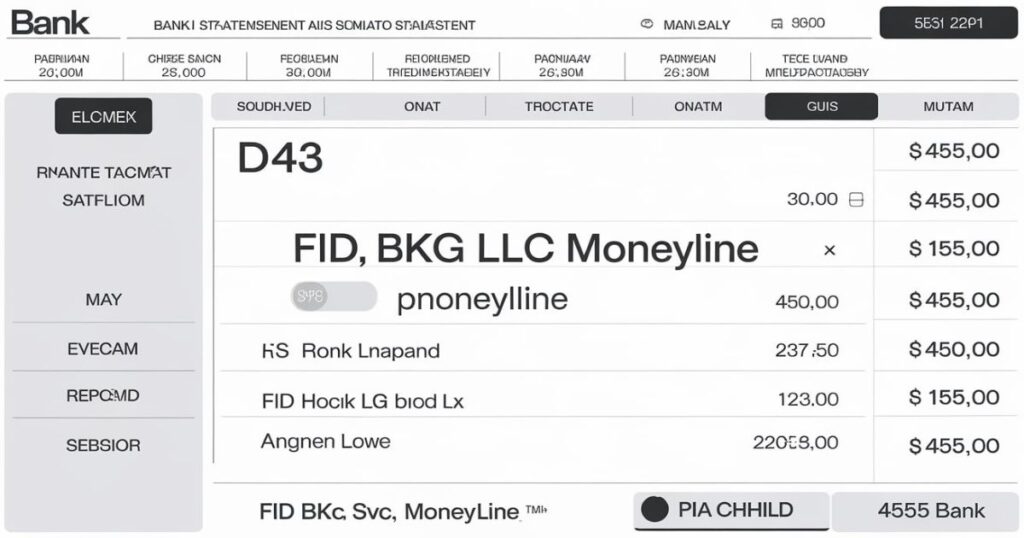

Ever glanced at your bank statement and stumbled upon a puzzling entry labeled “FID BKG SVC LLC Moneyline“? You’re not alone. This cryptic charge has left many scratching their heads, wondering if they’ve fallen victim to some sneaky financial shenanigans. But fear not! We’re about to embark on a journey to demystify this perplexing entry and shed light on what it really means for your wallet.

In this comprehensive guide, we’ll unravel the secrets behind the FID BKG SVC LLC Moneyline charge, explore why it might be gracing your bank statement, and equip you with the knowledge to handle it like a pro. So, grab your favorite beverage, settle in, and let’s dive into the fascinating world of financial jargon and investment lingo!

Unmasking the FID BKG SVC LLC Moneyline Charge

Let’s cut to the chase: FID BKG SVC LLC Moneyline is not some obscure secret society charge. It’s actually linked to a financial heavyweight you might be familiar with Fidelity Investments. This charge is essentially Fidelity’s way of leaving its signature on your financial transactions.

Fidelity Investments, for those who might not know, is a behemoth in the world of financial services. We’re talking about a company that manages a mind-boggling $4.5 trillion in assets. That’s trillion with a “T,” folks! To put that into perspective, if Fidelity’s assets were a country’s GDP, it would rank as the 4th largest economy in the world. Now that’s what I call financial clout!

The “FID BKG SVC LLC” part of the charge stands for “Fidelity Brokerage Services LLC.” This is Fidelity’s clever way of separating its brokerage arm from the main corporation. Think of it as Fidelity’s financial alter ego – same hero, different cape.

Now, let’s break down this charge even further:

- FID: Short for Fidelity

- BKG SVC: Abbreviation for Brokerage Services

- LLC: Limited Liability Company

- Moneyline: Fidelity’s term for their electronic funds transfer system

This charge could pop up for a variety of reasons, including:

- Buying or selling stocks

- Transferring funds between accounts

- Setting up automatic investments

- Paying for advisory services

- Withdrawing funds from your Fidelity account

Fascinating fact: Fidelity processes over 2 million trades each day. That’s more action than a blockbuster movie on opening night!

Read Also: Unlocking the Future: Why is Foresight Not Getting Traction with Business?

Why Did the FID BKG SVC LLC Moneyline Charge Pop Up on Your Bank Statement?

Now that we’ve unmasked our mysterious charge, let’s delve into why it might have made a guest appearance on your bank statement. The FID BKG SVC LLC Moneyline charge is essentially Fidelity’s way of saying, “Hey, remember that financial move you made? Here’s the receipt!”

This charge could appear for a multitude of reasons, all tied to your interactions with Fidelity Investments. Here’s a breakdown of some common scenarios:

- Investment Activities: If you’ve been playing the stock market through Fidelity, buying or selling securities, this charge might pop up.

- Fund Transfers: Moving money in or out of your Fidelity accounts? That could trigger this charge.

- Automatic Investments: Set up a recurring investment plan? Each transaction might be marked with this charge.

- Advisory Fees: If you’re using Fidelity’s wealth management services, this charge might represent your advisory fees.

- Account Maintenance: Sometimes, it could simply be a fee for maintaining your Fidelity account.

Here’s a handy table to help you identify what your charge might be for:

| Charge Amount | Possible Reason |

| $0 – $50 | Small investment or transfer |

| $50 – $500 | Moderate investment or advisory fee |

| $500+ | Large investment or significant fund transfer |

Remember, these are just ballpark figures. The actual amount can vary widely based on your specific transactions and agreements with Fidelity.

Pro Tip: Keep a transaction diary. Jot down any significant financial moves you make with Fidelity. This can help you quickly identify if a charge is expected or not.

The Many Faces of the FID BKG SVC LLC Charge

Just when you thought you had it figured out, surprise! The FID BKG SVC LLC charge likes to play dress-up. It can appear on your statement in various forms, each with its own special meaning. Let’s unmask these different disguises:

- FID BKG SVC LLC MONEYLINE: The most common form, indicating a general transaction.

- FID BKG SVC LLC MNY MKT SWEEP: Related to money market account activities.

- FID BKG SVC LLC CASH REDEMPTION: Indicates a withdrawal or cash-out.

- FID BKG SVC LLC DRIP PURCHASE: Connected to dividend reinvestment plans.

- FID BKG SVC LLC CONTR TO IRA: Represents contributions to an Individual Retirement Account.

And the list goes on! Fidelity has more variations than a chameleon has colors. Here’s a pro tip to help you decode these charges: Focus on the last part of the description. That’s usually where the specific type of transaction is indicated.

For instance:

- “CONTR TO” usually means a contribution to an account

- “WITHDRAWAL” is self-explanatory

- “SERVICE FEE” might indicate a maintenance or advisory charge

Creating a personal finance tracking system can be a game-changer. Use a spreadsheet or a budgeting app to log these charges. Over time, you’ll start to see patterns that can help you quickly identify what each charge represents.

Putting the Brakes on Unwanted FID BKG SVC LLC Charges

Alright, so what if you spot a FID BKG SVC LLC Moneyline charge that looks as out of place as a penguin in the Sahara? Don’t panic! Here’s your game plan:

- Verify the Charge: First things first, put on your detective hat. Check your Fidelity account activity to see if it matches the charge on your bank statement.

- Contact Fidelity: If something seems fishy, don’t hesitate to reach out to Fidelity. Their customer service number is 1-800-343-3548. Have your account number and the specific charge details ready.

- Dispute Unauthorized Charges: If you confirm that the charge is unauthorized, contact your bank immediately to dispute it. Many banks have specific time frames for reporting fraudulent activity, so act fast!

- Update Security Measures: Change your Fidelity account password and enable two-factor authentication if you haven’t already.

- Monitor Your Accounts: Set up alerts for any transactions on your Fidelity account. This can help you catch any unusual activity early.

Remember, prevention is better than cure. Regularly reviewing your statements isn’t just good practice; it’s your first line of defense against unauthorized charges.

Wrapping Up: Mastering Your Fidelity-Related Finances

And there you have it, folks! We’ve journeyed through the labyrinth of FID BKG SVC LLC Moneyline charges and come out the other side wiser and more financially savvy. Let’s recap the key points:

- FID BKG SVC LLC Moneyline is Fidelity Investments’ way of marking transactions on your bank statement.

- These charges can appear for various reasons, from buying stocks to paying advisory fees.

- The charge can take on different forms, each indicating a specific type of transaction.

- If you spot an unfamiliar charge, verify it with your Fidelity account activity and don’t hesitate to contact Fidelity or your bank.

As we sail into the future of digital banking, understanding these charges becomes increasingly important. Financial transparency is key, and being able to decode your bank statement is a superpower in the world of personal finance.

So, the next time you see a FID BKG SVC LLC Moneyline charge on your statement, you can smile knowingly. You’re not just another number in the system you’re a savvy investor, navigating the complex waters of finance with confidence.

Remember, your financial journey is uniquely yours. Stay curious, keep learning, and don’t be afraid to ask questions. After all, knowledge is the best investment you can make.